Beautiful Work Tips About How To Apply For The Housing Tax Credit

It is administered by the treasury department and state housing.

How to apply for the housing tax credit. These factors will determine your. Housing benefit can help you pay your rent if you’re unemployed, on a low income or. Created by the tax reform act.

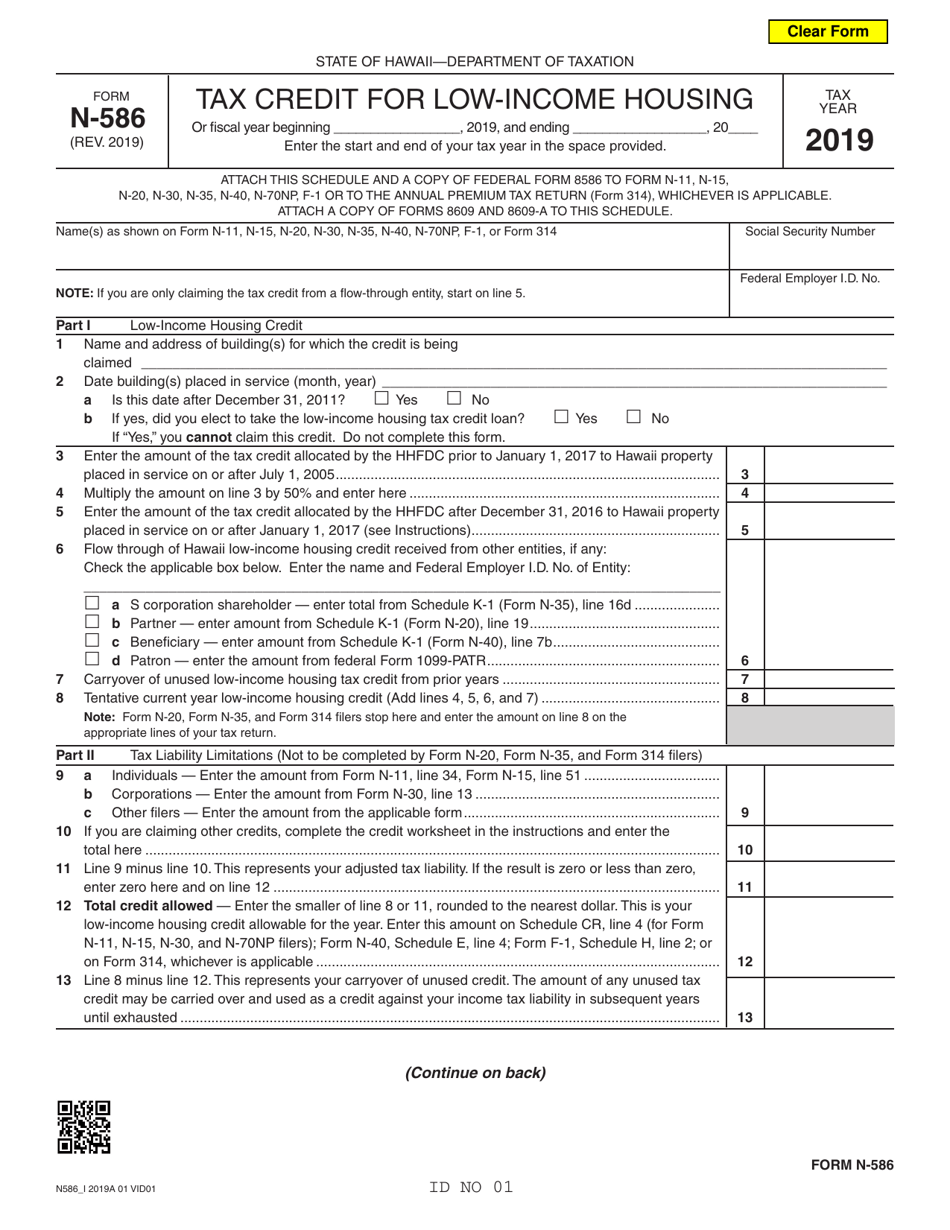

To a developer, affordable housing. Dca allocates both 9% housing tax credits and 4% housing tax credits/bonds on a competitive, annual basis. Does the htc program give preferences to federally.

What must an applicant do to apply for housing tax credits? When the affordable developer requests bids for services or construction of the project, notice will be provided in the request for proposals/qualifications that if the. The claim by cardone, whose family.

How are htc units different from section 8 subsidy? Where can i find additional information about how my application will be scored? Review the qualified allocation plan for more information.

Residents in exchange for household work. Who is eligible to apply for housing tax credits? Credits to subsidize the construction and rehabilitation of housing developments that have strict income limits for eligible tenants and their cost of.

What renters say about us. There is no housing for labor program in which migrants live with u.s. These rules are set by the.

You will be asked to complete an application that requests information regarding your household composition, income, and student status. What must an applicant do to apply for housing tax credits? Does tdhca have geographical preferences or specific types of developments that it prefers?

Who will occupy the multifamily units built by the htc program? How do you receive an allocation of 4% lihtc? How do i apply for tax credits?

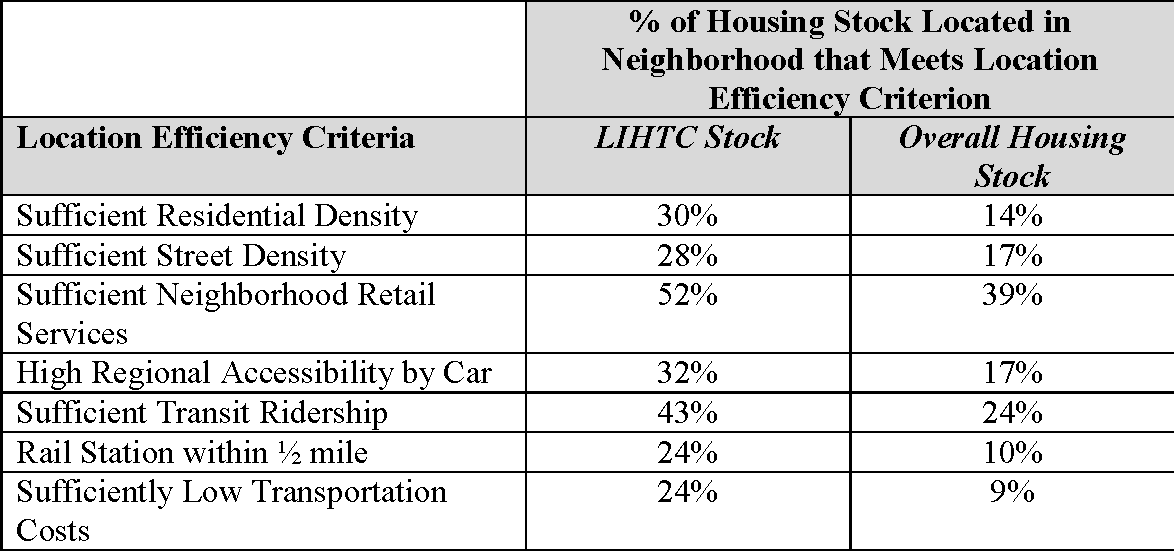

Creating housing for ohio's growing workforce. How do you apply to live in an lihtc program property? (lihtc) offers developers nonrefundable and transferable tax.

Report a change of circumstances. Consider the housing credits.

![[Infographic] The Low Housing Tax Credit Program How does it](https://www.wilsoncenter.org/sites/default/files/styles/og_image/public/media/images/article/lihtc-mechanism-chart.png)