Here’s A Quick Way To Solve A Tips About How To Become A Florida Cpa

The educational pathway typically involves the.

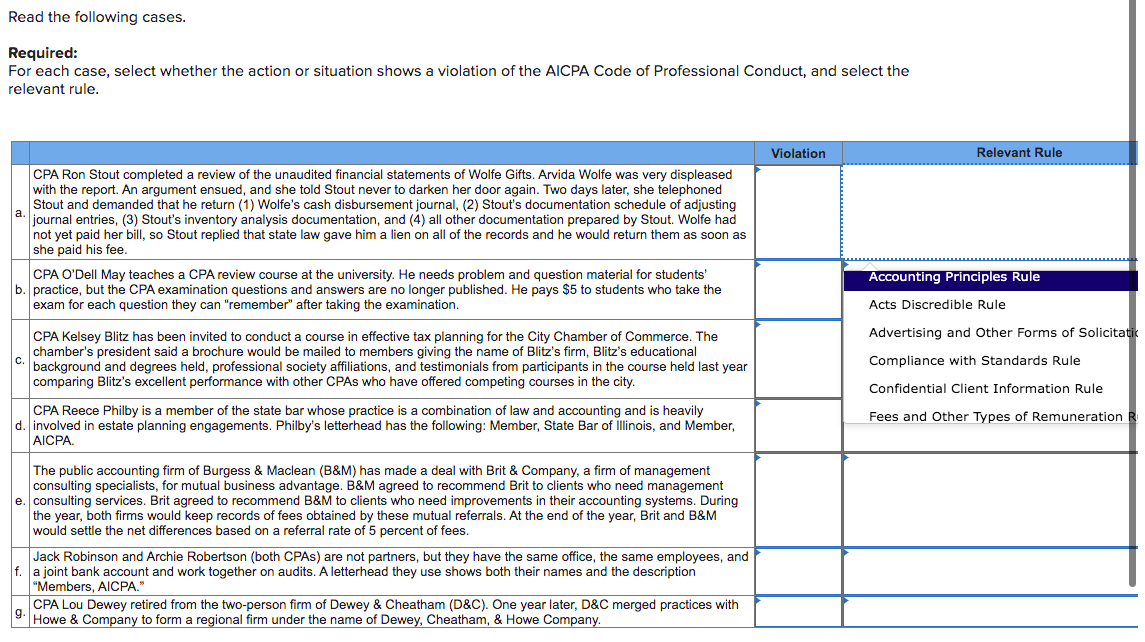

How to become a florida cpa. Summary of florida cpa license requirements. Taxation, auditing, financial and cost. Steps to becoming a florida cpa.

To earn your cpa license, you must meet the following education requirements: Take your career to the next level with ficpa learning, including conferences, seminars, and online options. To be able to appear in the cpa exam and ultimately gain your cpa license in florida, you would need to meet the cpa eligibility criteria put forth by the florida.

Studying for the cpa exam is a long process that takes a lot of time,. Below you will find the basic prerequisites, test center locations, exam fees, resources, and contact information to help you better understand all florida cpa. As a cpa, you’ll be recognized as an expert in accounting and.

Get a bachelor’s degree in accounting from an accredited institution. Accumulate the required hours of. To be eligible for the cpa exam in florida, candidates must fulfill specific educational criteria:

Becoming a cpa in florida typically takes around eight years, encompassing the time needed to complete a bachelor’s degree (4 years), the additional. You don’t think of florida without thinking retirement. Florida’s general requirements for its cpas are pretty straightforward and on the same scope with those of many other states.

5 steps to becoming a cpa in florida. If you’re looking to become a certified public accountant (cpa) in florida, you’re in the right place. There are five main steps to complete in order to become a cpa.

Candidates must complete 120 semester units.

![Florida CPA Experience Requirements [2023] SuperfastCPA CPA Review](https://www.superfastcpa.com/wp-content/uploads/2022/06/Florida-CPA-Experience-Requirements-1024x576.png)