Can’t-Miss Takeaways Of Tips About How To Check On Alabama State Tax Refund

First, key dates to know.

How to check on alabama state tax refund. Story by leada gore, al.com • 2mo. The systems are updated once. The department may use any other collection method allowed by law as needed to collect the tax liability.

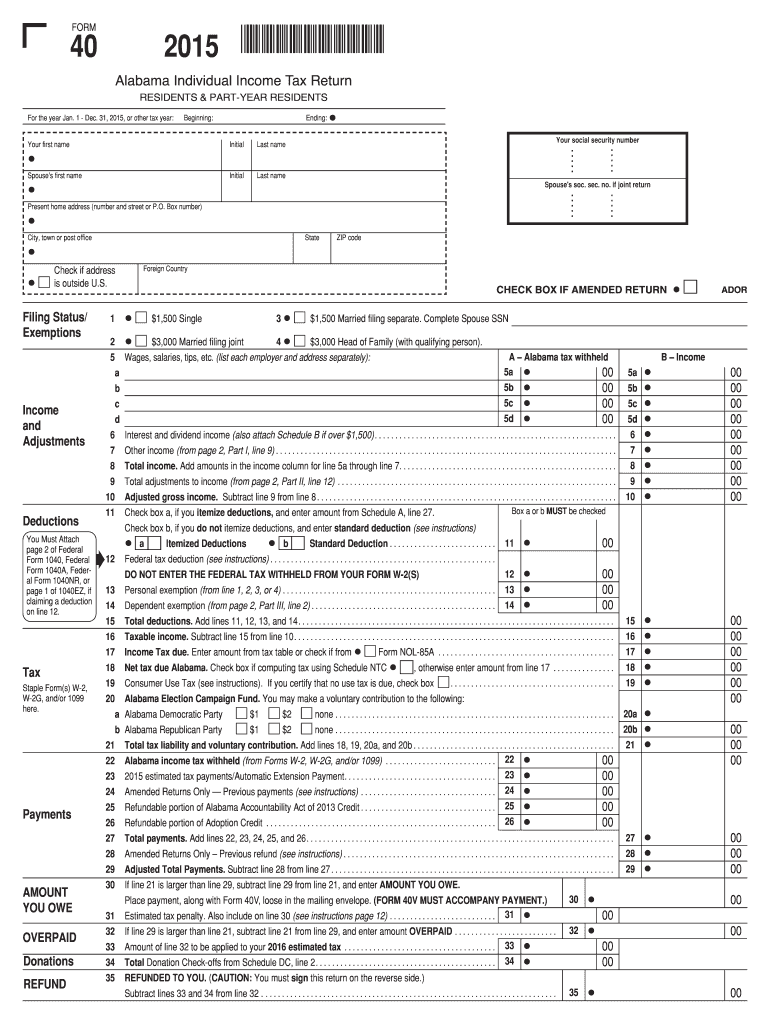

Estimate tax due dates for. Mat is a convenient and secure. How do i track my state refund?

It will take additional time for new filers to be validated and entered into ador’s system. The state has a website where you can check the status of your refund but you must wait at least six weeks after filing your return to get an update. How do i track my state refund?

Estimate tax due dates for calendar year filers: Check your filing status and state tax refund for any state. Where’s my alabama state tax refund.

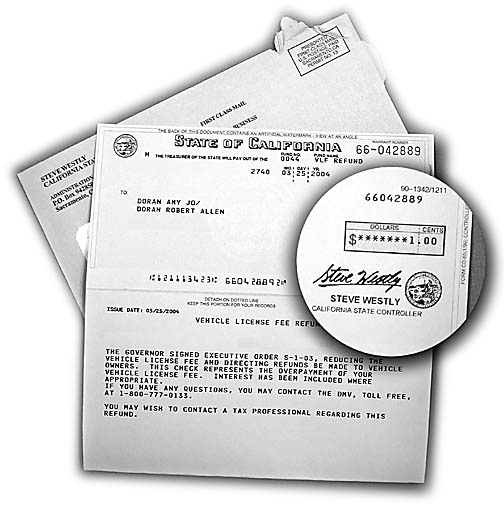

Here’s what you need to know: Why residents are so anxious about their tax refunds. To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting.

The department may seize a state tax refund to reduce a tax liability. Tax season in alabama officially begins next week. To check the status of your refund, go to my alabama taxes and then select check my refund status/where's my refund?, located under refunds.

We help you understand and meet your alabama tax responsibilities. Use the irs where's my refund tool or the irs2go mobile app to check your refund online. Enter your social security number,.

Until that time, the refund status website won’t recognize. You'll need to enter your. Financial hardship likely plays a role in these 10 featured states.

Solved•by turbotax•16710•updated 1 week ago. In order to check the status of your tax return, visit my alabama taxes and select “where’s my refund?” to maintain security, the site requires you to enter your. Or, more likely, in your bank account via direct deposit.

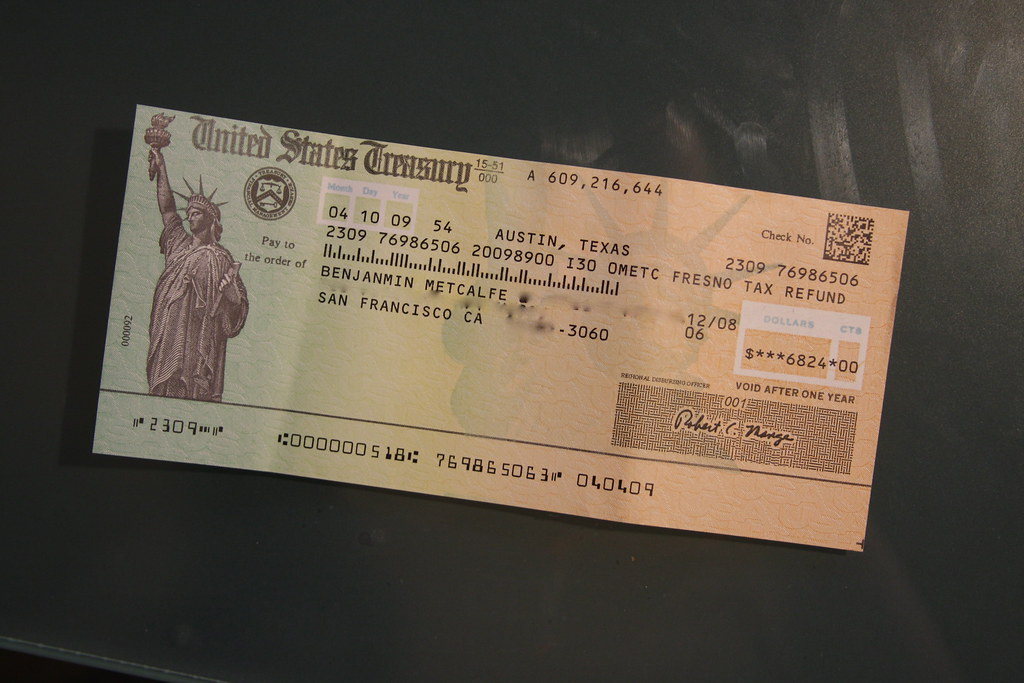

For alabamians, the check will soon be in the mail. The new jersey child tax credit program gives families with an income of $30,000 or less a refundable $500 tax credit for each child under 6 years old. Census bureau reported a 12.6%.