Stunning Info About How To Start A Ponzi Scheme

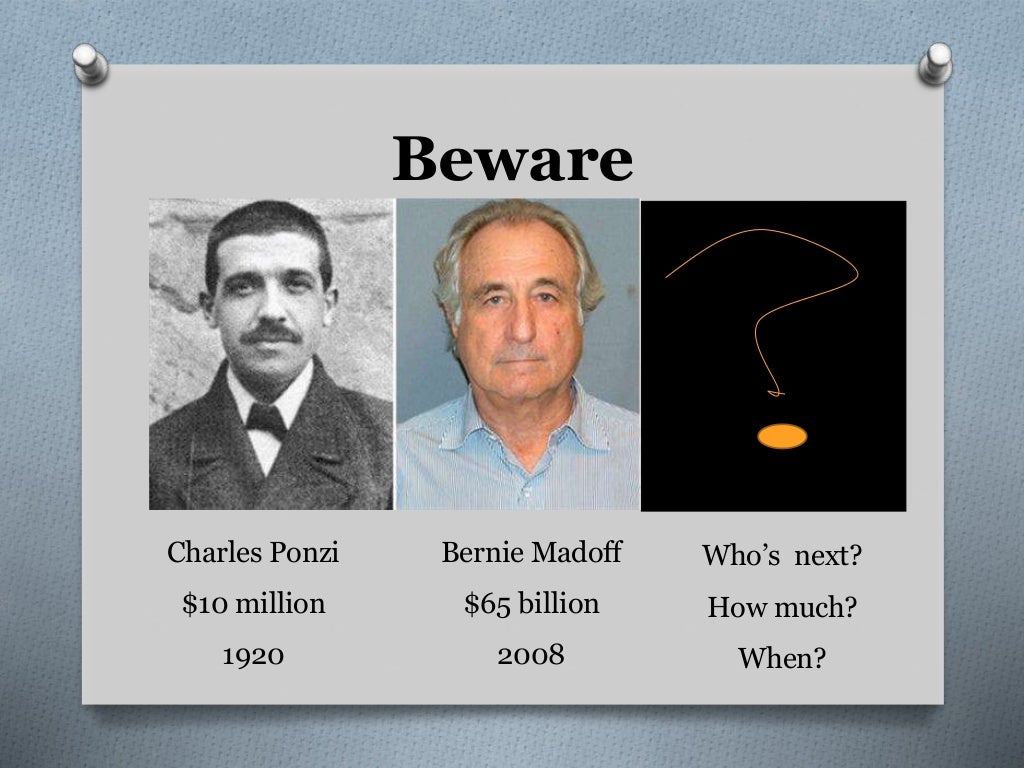

But he was the guy who got the name.

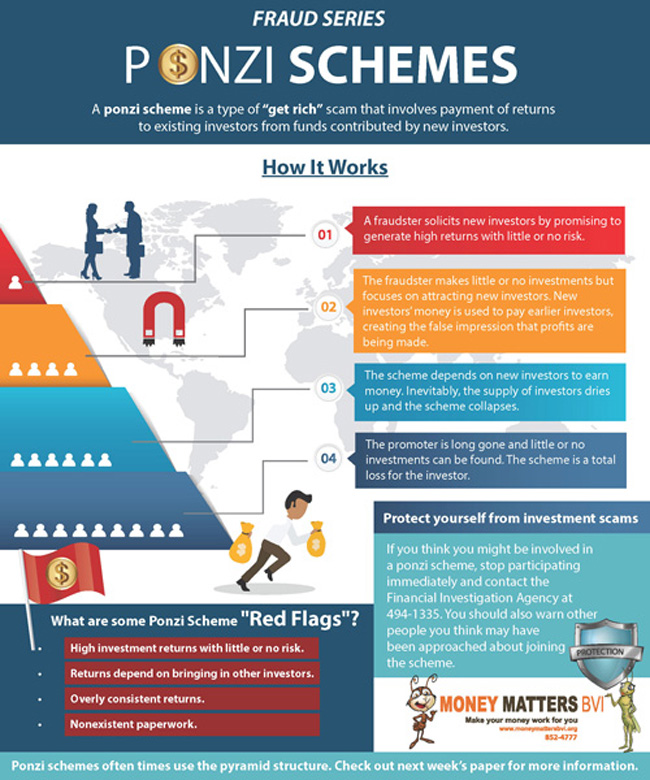

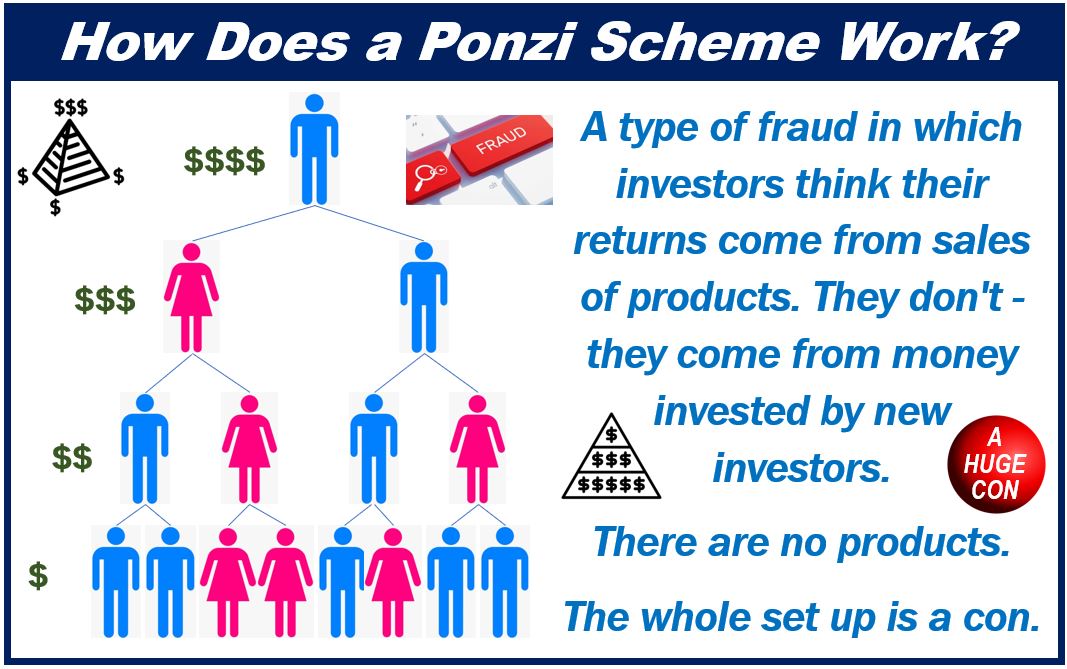

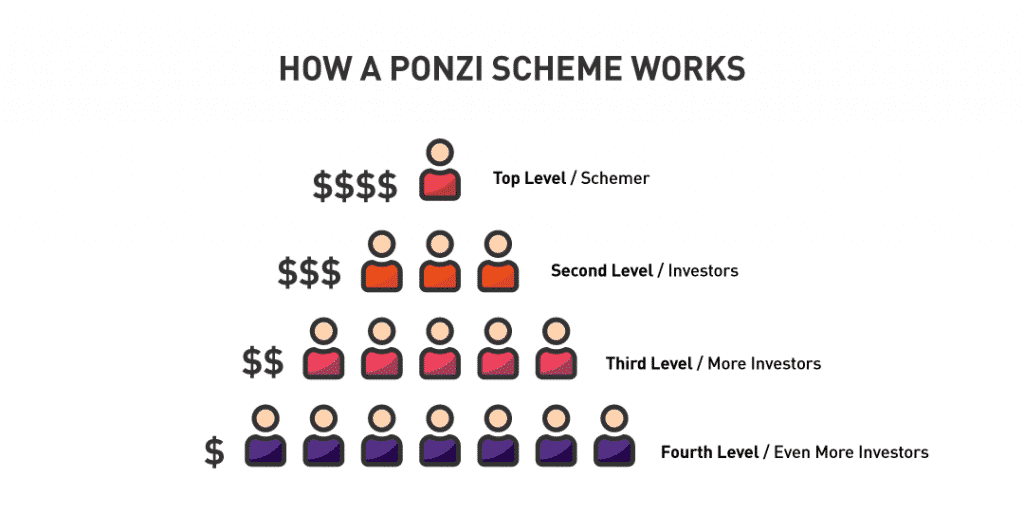

How to start a ponzi scheme. Protect yourself from financial fraud. Administrators of the fund allege the company. A ponzi scheme (or a ponzi scam ) is an investment scam in which early investors are paid returns from funds contributed by later investors, although it has taken.

It’s really easy to run a ponzi scheme. Gary rathbun, who hosted brokered investment programs on wspd toledo, has been accused of running a ponzi scheme that bilked investors out of $72 million. A ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors.

Be skeptical if someone tries to sell you on an investment that has huge or immediate returns for little or no risk, this is a signal it could be fraud. The ponzi scheme generates returns for early. 60 schemes got busted in 2019 which raised $3.2 billion.

Here are a few significant indicators that should make you suspicious: A ponzi scheme is an investment fraud designed to scam those looking for easy and guaranteed earnings. A ponzi scheme is a type of security fraud in which the central operator perpetually tricks investors into putting money into a nonexistent asset or into an asset.

Dec 17, 2008,06:50pm est this article is more than 10 years old. The scheme dupes investors into believing that. Your ability to identify a ponzi scheme is critical to protecting yourself and your money.

If you come across an investment with any of these. Prior to lcf’s collapse in 2020, the minibond firm had persuaded more than 11,500 investors to invest £237m in the scheme. You get people to invest in your “fund” by saying you can promise them guaranteed returns of some reasonable annual percentage.

It involves using payments collected from new investors to pay off the earlier investors. Flashback to the beginning of ponzi schemes. Being dubbed the ponzi scheme is certainly not without reason.

As alleged, soon after weinstein got out of jail after receiving a presidential commutation, he picked his ponzi schemer’s playbook back up and allegedly started. Learn about the dark side of finance with ponzi schemes: Registration is important because it provides.

A ponzi scheme is one of the oldest and most common types of scams, but it’s still used successfully every day to lure innocent people. How to identify a ponzi scheme. Ponzi schemes typically involve investments that have not been registered with financial regulators (like the sec or the fca ).

Ponzi schemes typically involve investments that are not registered with the sec or with state regulators. Share to facebook share to twitter share to linkedin every investor on the planet has experienced a range of. A ponzi scheme is an investment scam that promises unjustifiably high returns to investors at minimal or no risk.