Favorite Tips About How To Claim Housing Tax Credit

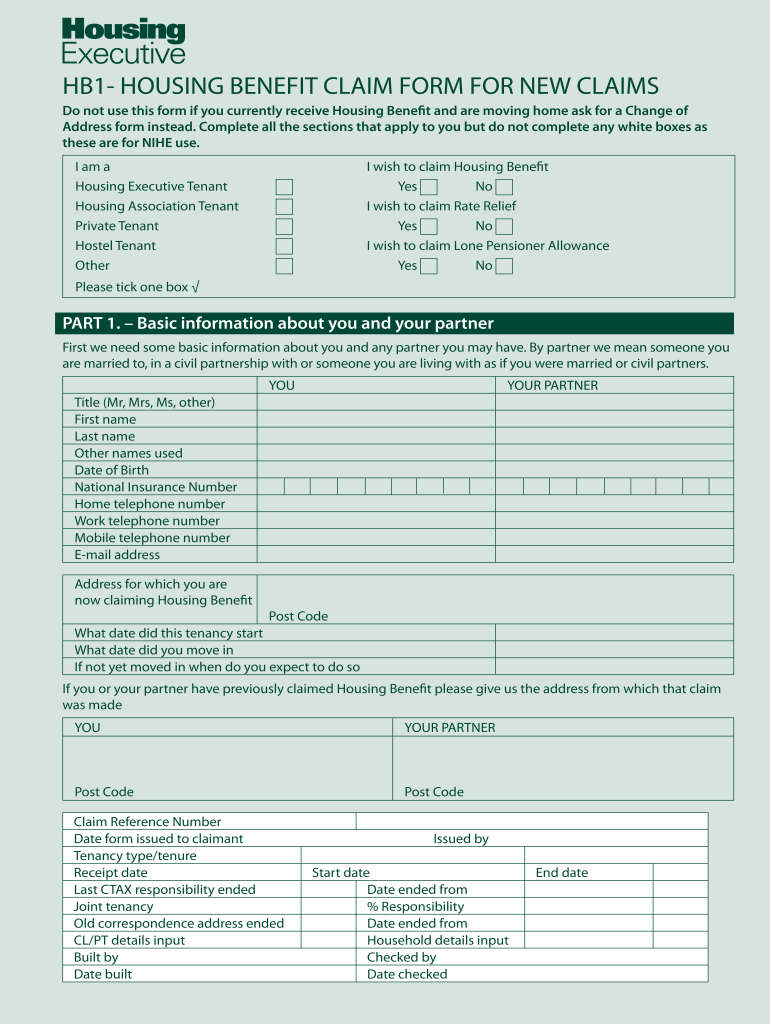

This is called universal credit housing costs.

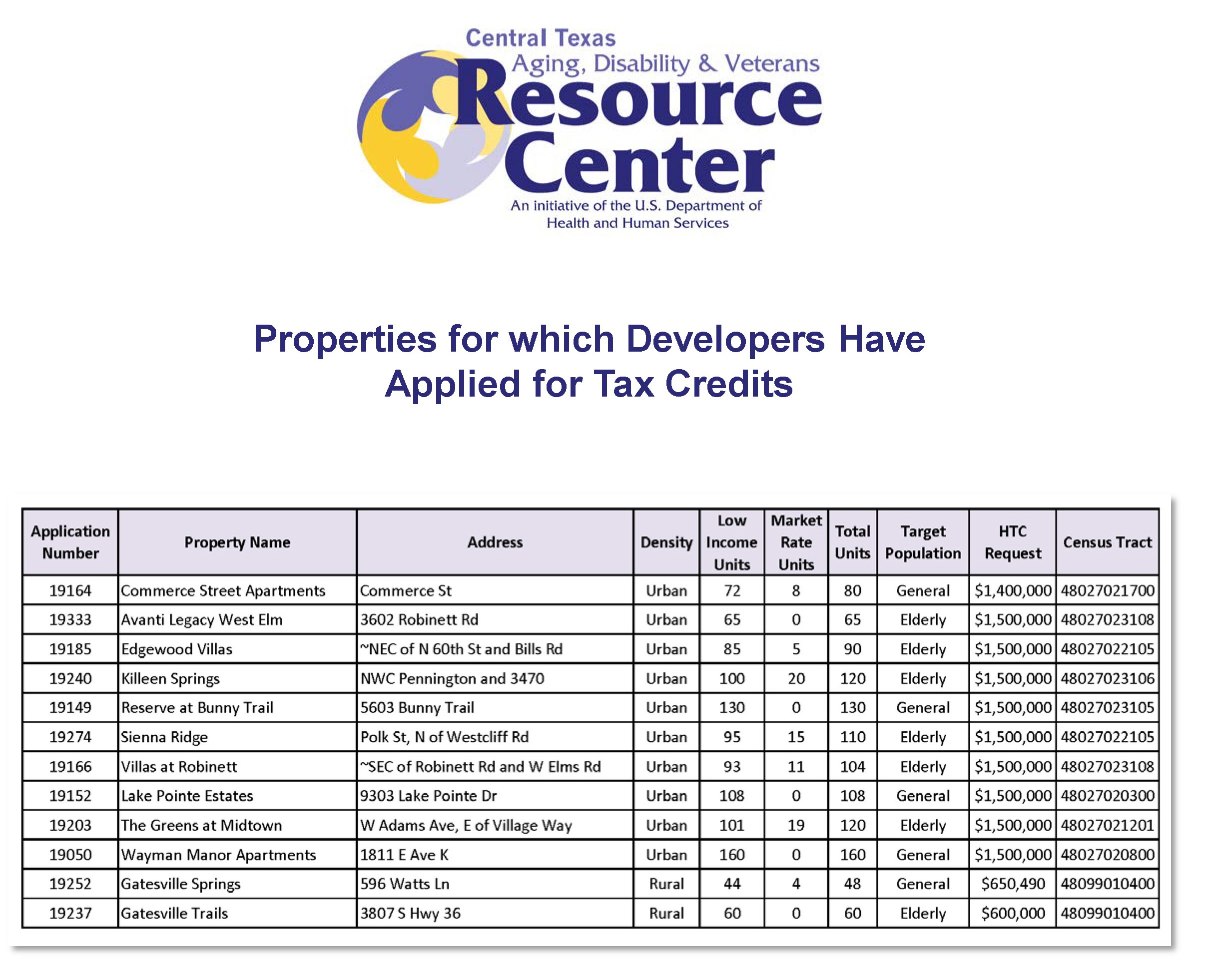

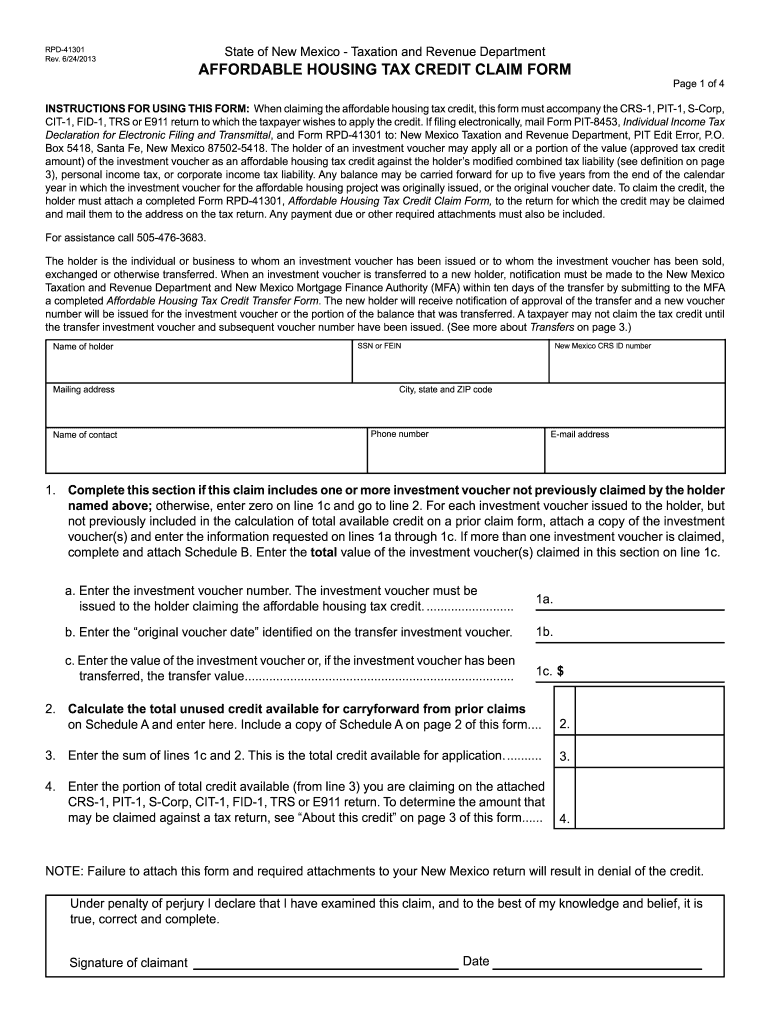

How to claim housing tax credit. The lihtc gives real estate investors and developers an incentive to build or renovate buildings to increase the. The low income housing credit (lihtc) program is one of those ways. This article details how the program works, including:

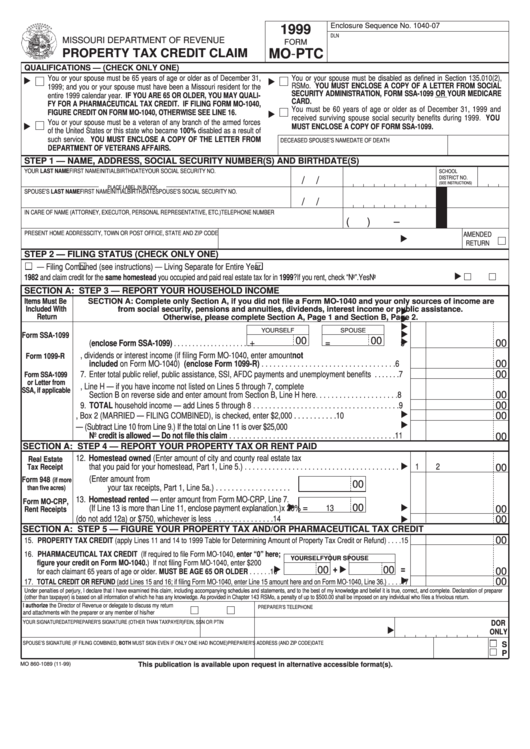

A $1,000 tax credit would reduce their total tax bill to $9,000. You have savings of less than £16,000. You’ll need to update your existing tax credit claim by reporting a change in your circumstances online or by phone.

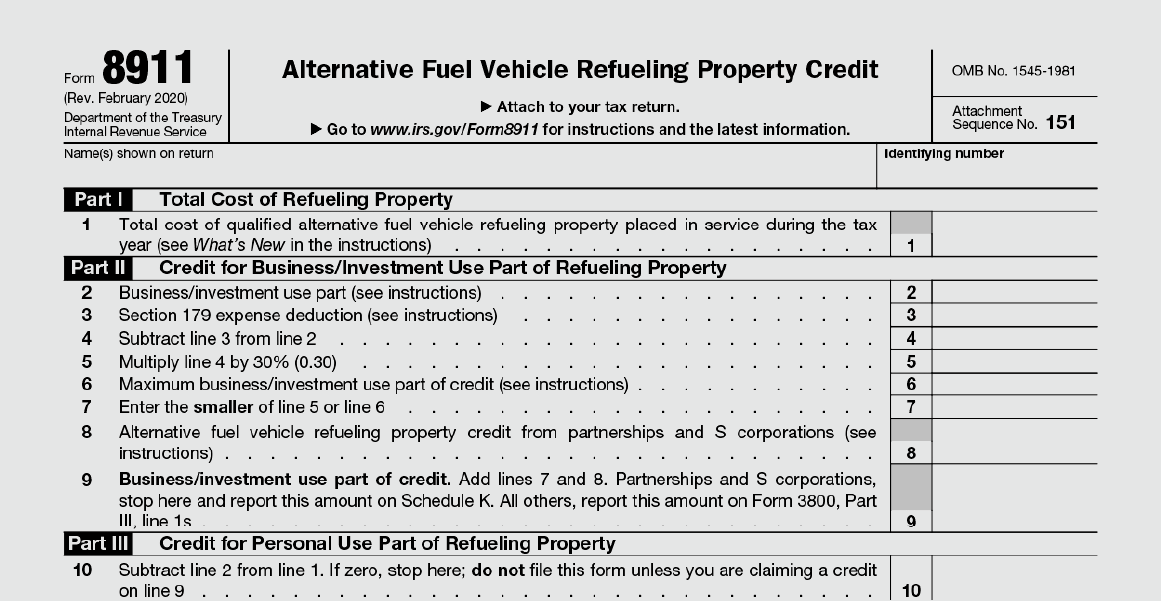

This credit is now known as the clean vehicle credit. Check who can get housing benefit. The federal tax credits for energy efficiency were extended as part of the inflation reduction act (ira) of 2022.

Only a portion is refundable this. According to irs figures, there were 344,000 such claims in the bluegrass state that tax year, with the average credit payout at about $2,500. A $100,000 position in bam produces $3,750 in dividend income per year.

On this page about the credit who's eligible for the credit how much is the credit how to claim the credit about the credit the b.c. Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump. There are three ways to meet the income test:

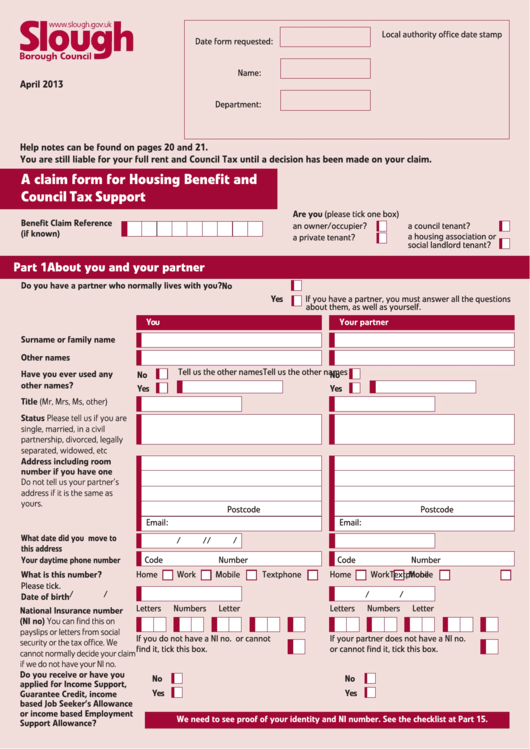

To claim housing benefit you usually have to: You’re on a low income or claiming benefits. If you cannot apply for tax credits, you can apply for.

As an example, if you spent $6,000 on education in 2023, you can claim 20%, or $1,200. The maximum tax credit available per kid is $2,000 for each child under 17 on dec. How much is the 2024 child tax credit?

If you claim before the deadline date on your migration notice, then some normal universal credit eligibility rules do not apply to. You and your partner have both reached state pension age one of you has reached state pension age. If you spent $12,000, you can claim 20% of your first $10,000 in costs, or.

When you make a new claim for universal credit your housing costs will usually be paid as part of your. Owners or developers of projects receiving the lihtc agree to meet an income test for tenants and a gross rent test. Have a low income or be claiming other benefits.

Were you to claim the dividend tax credit on those dividends, the amount would be. So, if you made any qualifying home improvements to your. Only a portion is refundable this year, up to $1,600 per child.